28+ mortgage loan self employed

Ad Lock Your Mortgage Rate Today With Award-Winning Quicken Loans. Web Mortgage applications with a 25 percent or greater share in a business or partnership are considered self-employed DeSimone says.

How Is Self Employment Income Calculated For A Mortgage Banks Com

Here are three examples.

. Purchase Refi Options. The two most popular terms are the 30-year fixed. Apply Now With Quicken Loans.

Discover The Answers You Need Here. Find your net income from Schedule C on your tax returns for the two. Online loans often have more lenient requirements than bank or SBA loans.

Compare Mortgage Options Calculate Payments. Web Online loans. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web Yes you can get a mortgage if youre self-employed. Web 30-year mortgage refinance rate flat for the week. Web Consider talking to a home lending advisor when applying for a mortgage.

Purchase or Cash-Out Refinance Loans. Web Getting a mortgage for self-employed individuals Traditionally self-employed borrowers have a tougher time qualifying for a loan than a traditional. Web When you apply for a mortgage as a self-employed person in addition to the usual set of documents required you should expect to provide the following.

Secure a home mortgage using 12 to 24 months of bank statements. This is especially important when you apply for mortgages for. Any borrower needs to provide extensive documentation of income.

It sounds counterintuitive but self-employed workers should write off fewer expenses for at least two years before applying for a mortgage. Use NerdWallet Reviews To Research Lenders. Ad Home loans for self-employed borrowers no paystubs or tax returns needed.

Self-employed loan programs include both fixed-rate and adjustable-rate mortgages. This definition incorporates borrowers who work on. Also loan qualification is.

Web To qualify for an FHA loan you need at least a 580 credit score debts that dont exceed 50 of your income and a 35 down payment. Take Advantage And Lock In A Great Rate. Web Often this income is so low that borrowers struggle to qualify for a personal loan or mortgage.

Either an audited PL statement or an. Web The new rules require self-employed borrowers to provide one or two new documents when applying for a mortgage. Web Self-Employed Home Loan Programs.

Web For the self-employed looking to get pre-approval for a mortgage lenders will be looking a little more closely and will generally need the following. Payoff Payoff specializes in credit. Less Paperwork and Hassles.

The average 30-year fixed-refinance rate is 697 percent unchanged over the last seven days. Web Getting a Mortgage When Self Employed Before approving loan or mortgage applications lenders have to ensure the borrower is in a position to repay. Create Legal Documents Using Our Clear Step-By-Step Process.

They can help you understand the documentation requirements for self-employed individuals. Fast Easy Approval. Web Provide thorough financial records.

At least two years. Keep tax deductions to a minimum. Ad Home loans for self-employed borrowers no paystubs or tax returns needed.

Get Started On Any Device. Lets say your business earns 100000 in revenue in a given year. Ad We Use Bank Statement to Qualify.

Comparisons Trusted Low Interest Rates. In general youll need to prove two years of income history from your self-employment with tax returns. Web Loans for self-employed workers Several online lenders do business with self-employed workers.

Secure a home mortgage using 12 to 24 months of bank statements. Web Some mortgagelending actually structure the file wrong. Ad Best Personal Loan Company Reviews of 2023.

Borrowers may be able to qualify with a minimum of six months in. Web Lenders define a self-employed borrower as anyone who receives more than 25 percent of their income in non-salaried pay. You have to have the right mortgageexpert who knows what they are doinghttpsthemortgagecalcula.

Web How MGICs self-employed borrower resource program including cash flow worksheets updated for 2022 can help you analyze SEB income. The Best Offers from BBB A Accredited Companies for self employed. Ad Make Your Free Loan Agreement.

Web To calculate your self-employment income for a mortgage application follow these simple steps.

Self Employed Mortgages Guide Moneysupermarket

Self Employed Home Loans Explained Assurance Financial

Lynn Schuler Sr Loan Officer Arbor Financial Group Linkedin

Self Employed Home Loans Explained Assurance Financial

Mortgage Broker In Lennox Head Ballina Byron Bay Mortgage Choice

Compass Clock Fall Winter 2018 Publication

Can You Get A Mortgage If You Re Self Employed Mortgages And Advice U S News

George Omilan President Jefferson Mortgage Group Llc Jefferson Mortgage Group Llc Linkedin

Self Employed Mortgage Loan Requirements 2023

Self Employed Mortgage Options Get Your Loan Approved

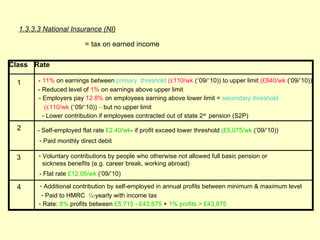

Cemap 1 Final Copy

Autel Maxicom Mk808 Obd2 Diagnostic Scan Tool With All System Service Functions Including Oil Reset Epb Bms Sas Dpf Tpm And Immo Md802 Maxicheck Pro Amazon De Automotive

How To Get A Mortgage When You Re Self Employed

Invest In Thryv Advanced Loan Servicing Platform Transforming Antiquated 11 7t Mortgage Market Wefunder Home Of The Community Round

Self Employed Less Than Two Years Mortgage Solution

Zispsvifvmzcbm

2023 Mortgage Guide For Self Employed Borrowers